Uninsured Motorist Coverage: A Must-Have for Drivers?

Introduction to UM/UIM Coverage

Understanding the Basics of Uninsured and Underinsured Motorist Protection

Uninsured (UM) and Underinsured Motorist (UIM) coverage provide essential protection when a driver without proper insurance hits your vehicle. Imagine driving home from work and suddenly, crunch! Another car collides with yours. Their mistake should not harm your wallet if they’re uninsured or underinsured, right? That’s where UM and UIM step in, and notably, uninsured motorist bodily injury coverage steps up to ensure you aren’t left financially burdened by their inability to pay. They cover your expenses, such as vehicle repairs and medical bills that the other driver’s insurance can’t fully cover. Additionally, ensuring you have sufficient motorist bodily injury coverage limits can be crucial for peace of mind on the road.

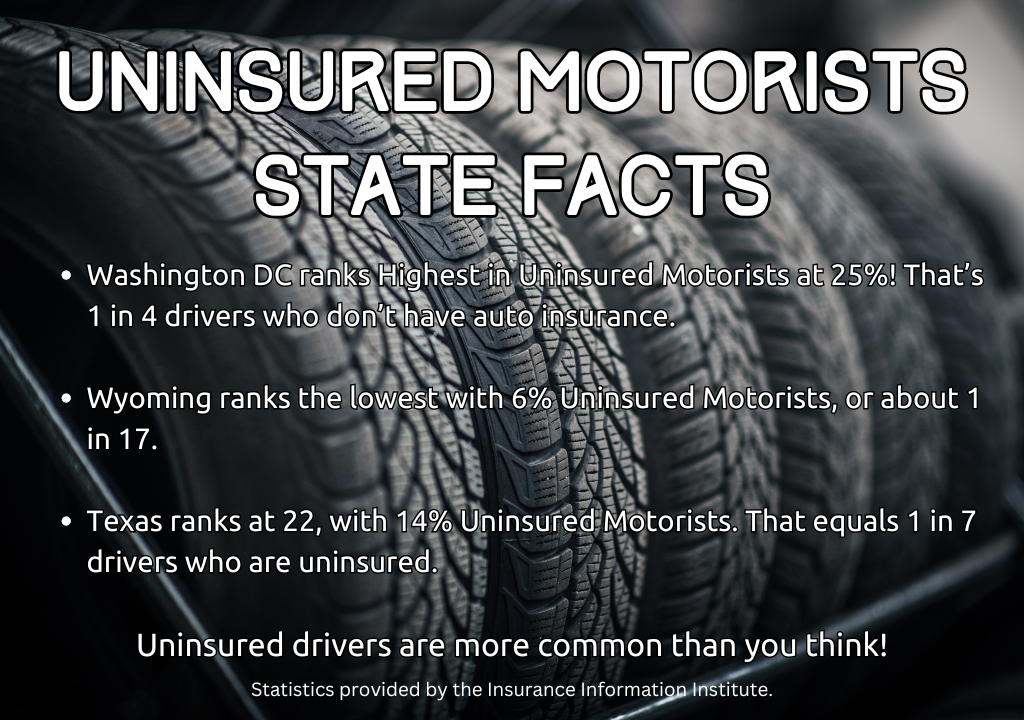

The Rising Concern of Uninsured Drivers on the Road

The road is more risky than it may appear, not just because of traffic but due to uninsured drivers too. Did you know that almost 13% of drivers in the U.S. have no auto insurance? That means, on any given day, crossing paths with an uninsured driver is not a matter of if, but when. In some states, the number of uninsured drivers jumps above 20%. Now, that’s quite a gamble to take every time you buckle up! If they cause an accident, and there’s no insurance in place, it’s you who might have to foot the bill. This growing concern highlights the genuine need for UM/UIM coverage for your financial safety net.

The Critical Need for UM/UIM Coverage

How UM/UIM Acts as Your Financial Guard

UM/UIM coverage is like having a financial bodyguard for your bank account when an accident occurs. If the person at fault can’t pay up because they lack insurance or don’t have enough, that’s when your UM/UIM steps in. It acts as a buffer to absorb the financial hit that would otherwise knock your savings out cold. Medical treatments, lost wages, pain and suffering – all these costs can mount quickly, and UM/UIM ensures you’re not left to fend off these expenses alone. Think of it as your plan B, ensuring you and your family won’t face financial hardship following an unforeseen incident on the road.

The Scenarios Where UM/UIM Becomes Essential

UM/UIM becomes crucial in several real-world driving scenarios. Consider a hit-and-run incident, where the responsible party vanishes, leaving no trace or insurance information. Or, picture an accident where the at-fault driver’s insurance is not enough to cover the total damages incurred. It’s also possible you’re hit by a driver who, unbeknownst to them, has lapsed insurance due to a missed payment. Unfortunately, even if you’re the safest driver, these incidents are beyond your control, making UM/UIM coverage indispensable. It turns unfortunate accidents involving irresponsible or misinformed drivers into manageable events, without jeopardizing your financial well-being.

Insight into Coverage Requirements and Legislation

States Where UM/UIM Is Mandatory

You’ll want to know where UM/UIM is not just an option but a requirement. H3: States Where UM/UIM Is Mandatory

You’ll want to know where UM/UIM is not just an option but a requirement. If you’re from Connecticut, Kansas, Maine, or a host of other states, such as Maryland, Minnesota, Nebraska, your state says UM/UIM is a must. In Massachusetts, automobile insurance coverage includes a component of uninsured motorist coverage as a legal necessity. This mandated coverage varies, with some states needing coverage for bodily injury only, while others require protection for property damage as well. Laws differ, and in some places like New Hampshire and Virginia, UM/UIM is necessary only if you choose to purchase car insurance. It’s also important to note that these requirements can evolve, so a current review of your state’s insurance mandates is a wise move. Reach out to your local insurance representative or check official state resources to stay informed.

Legislation That Influences UM/UIM Policies

The legislation impacting UM/UIM policies can be as complex as a spaghetti junction. Each state has its own set of laws that dictate the ins and outs of required UM/UIM coverage. Some states have enacted laws that allow for something called “stacking” – letting you combine the UM/UIM limits of multiple vehicles in your household for a higher level of protection. Other legislation may address issues like how insurers can handle claims, the validity of certain policy exclusions, or the disclosure requirements when you choose to reject UM/UIM. It’s essential to keep abreast of the legislative trends and changes in your state since they can have a direct impact on your coverage and your rights after an accident. Always consult with an insurance professional or legal expert to understand how these laws apply to you.

Breaking Down UM/UIM Coverage Components

What UM/UIM Covers in Case of an Accident

In the unfortunate event of an accident, UM/UIM has your back by covering various costs that could otherwise derail your finances. H3: What UM/UIM Covers in Case of an Accident

In the unfortunate event of an accident, UM/UIM has your back by covering various costs that could otherwise derail your finances. Property damage liability is a significant concern for most drivers, and that’s where Uninsured Motorist Property Damage can be a game-changer. It may cover the damage to your car, offering support similar to what you’d receive from the at-fault driver’s automobile liability insurance coverage, if they had any. For UM bodily injury, you can expect coverage for medical expenses, pain and suffering, and lost wages for you and your passengers. UM property damage, meanwhile, may help pay to repair or replace your vehicle and cover damage to personal items inside the car. However, be mindful of your collision deductible when filing a claim, as this out-of-pocket expense could affect your financial reimbursement in such events. Essentially, UM/UIM steps into the shoes of the at-fault driver’s insurance, ensuring support for the physical and material setbacks thrust upon you by the accident. Always remember that how much it covers hinges on your specific policy and liability coverage limits, as well as state regulations.

Difference Between Uninsured and Underinsured Motorist Coverage

Grasping the difference between uninsured and underinsured coverage is easier when you break it down. Uninsured Motorist (UM) coverage, an essential aspect of liability car insurance, is like a safety net; if the other driver has no insurance, UM steps up to cover your losses. It’s there for you when the other party breaks the law by driving without automobile insurance or if you fall victim to a hit-and-run accident. In such cases, filing an uninsured motorist claim can provide you with the compensation needed for repairs and medical expenses, up to your policy’s limit.

Underinsured Motorist (UIM) coverage takes over when the other driver’s insurance is too thin to cover your bills. It fills the financial gap if the at-fault driver’s policy limits are too low to cover the total cost of the damages they are responsible for. Both types of coverages are integral components of a robust auto insurance policy, ensuring protection in different situations where the other driver’s insurance either doesn’t exist or just isn’t enough.

According to the Insurance Research Council, in 2022, 14% of drivers were uninsured, an increase of 3% since 2019. Third-party claims for injuries caused by uninsured and underinsured drivers have increased by 40% since 2021.

Cost Considerations and Coverage Limits

Estimating the Cost of UM/UIM Insurance

Estimating the cost of UM/UIM coverage helps you make an informed budget decision. On average, UM bodily injury coverage costs about $136 annually. Though linked with bodily injury limits, underinsured motorist bodily injury (UIMBI) rounds up to approximately $90 a year. Meanwhile, uninsured motorist property damage (UMPD) might add around $36 annually to your policy, and underinsured motorist property damage (UIMPD) comes in close at an average of $46 yearly. Bear in mind these are averages; your actual cost could vary based on your state of residence, driving history, and how much coverage you seek. It’s a small price to consider, given the financial protection it offers. Shopping around ensures you find a premium that suits your budget without skimping on coverage.

Determining Adequate Coverage Limits for Your Needs

Choosing the right coverage limits for UM/UIM insurance is a balancing act. When seeking to purchase liability coverage, it’s crucial to consider how much coverage you need to protect your assets but also to take into account your budget. Reflecting on your net worth, you might consider matching your UM/UIM limits with your regular liability insurance coverage; after all, you’d want as much protection for yourself as you’d provide to others in an at-fault accident. Opting for higher limits offers more extensive coverage but will increase your premium. A common starting point suggested by experts is $100,000 per person and $300,000 per accident—the same recommended minimum for standard liability coverage. Remember, investing in adequate liability coverage isn’t always about finding the cheapest option; it’s about ensuring your choice reflects the potential costs of a serious accident that might exceed the minimum state-required liability limits. Consulting with an insurance professional can clarify the nuances of your coverage needs and help you make an informed decision.

Policyholder Actions After an Encounter with an Uninsured Driver

Steps to File a UM/UIM Claim Successfully

To file a UM/UIM claim successfully, time is of the essence. H3: Steps to File a UM/UIM Claim Successfully

To file a UM/UIM claim successfully, time is of the essence. First, report the accident to the police and your insurer promptly to support your motorist claim. Stick to the facts when describing the incident and avoid accepting blame or making any admissions. Gather evidence at the scene: take photos, note the time and place, and collect witness information if possible. If a driver hits your vehicle and flees, these details are particularly crucial when filing a claim against your policy’s uninsured motorist coverage. Get a copy of the police report once it’s available; it’s indispensable for your insured status to be properly considered in the claim. Then, fill out your insurer’s UM/UIM claim form detailing your losses. Often insurers require a “proof of loss” form, so have your medical records, car repair estimates, and any other related expenses ready for submission. Retain all documentation and follow up regularly to ensure your claim is being processed. If you’re feeling overwhelmed, consider hiring an attorney to navigate the intricacies of the claim for you.

The Pitfalls to Avoid When Dealing Without UM/UIM

Dealing without UM/UIM insurance is like walking a tightrope without a safety net. The first pitfall is financial vulnerability. Without it, an accident with an uninsured driver can lead to massive out-of-pocket expenses for medical bills and car repairs. Then there’s the legal limbo. You could try to sue the at-fault driver, but if they’re uninsured, they likely lack assets, making it difficult to recover damages. Time and stress add to the toll, as chasing down payments and negotiating with insurers can be a lengthy and exhausting process. Having UM/UIM means peace of mind—knowing you’re covered is worth the investment.

Navigating Through Common Misconceptions

Debunking Myths About UM/UIM Insurance

Let’s clear up some common myths about UM/UIM insurance. Myth one: “It’s unnecessary if you have health insurance.” Not true! Health insurance won’t cover all accident-related expenses, such as lost wages or pain and suffering. Myth two: “UM/UIM is too expensive.” In reality, it’s a small addition to your premium considering the extensive coverage it offers. Myth three: “I rarely drive, so I don’t need it.” Remember, even if you’re not on the road often, accidents can happen anytime, anywhere—to you or your parked car. Lastly, there’s the belief that “good drivers don’t need it.” Even the best drivers can’t control other people’s actions. UM/UIM coverage protects you from those unpredictable moments on the road.

Health Insurance vs. UM/UIM Coverage – Understanding the Difference

It’s a common question: isn’t health insurance enough? The truth is, health insurance and UM/UIM coverage are not substitutes but rather complement each other. Health insurance kicks in for medical bills, but it typically won’t cover all the costs of an auto accident, such as deductibles, co-pays, or treatments not included in your policy. It also won’t provide for lost wages or pain and suffering. On the flip side, UM/UIM is specifically designed to fill those gaps. It ensures that you’re not left financially burdened after an incident involving an uninsured or underinsured driver. To give you full protection on the road, having both types of insurance working together is the smart choice.

Maximizing Your UM/UIM Protection

Considering ‘Stacking’ Options for Enhanced Coverage

Stacking options can seriously amplify your UM/UIM protection. If you have multiple cars, you might be able to ‘stack’ their coverage limits, giving you a higher overall limit. Let’s say each of your two cars has a UM policy limit of $25,000. If stacked, your coverage could rocket to $50,000 for one accident. Remember, though, not every place allows it, and some insurers have anti-stacking provisions. Also, since stacking boosts your coverage, expect a bump in your premium. Weighing the extra cost against the potential benefit is key—especially if you’re in a high-risk area for uninsured drivers.

Assessing Whether You Need More Than the State-Mandated Minimum

When it comes to insurance, the state-mandated minimum might not be enough. If you have significant assets, or if you’re frequently ferrying family members around, it’s smart to exceed the minimum. Accidents often rack up costs that far surpass these basic limits. Consider your daily driving habits, your personal comfort with risk, and consult with a financial advisor to determine the layer of security you need. Opting for higher UM/UIM coverage provides you with greater peace of mind and financial protection, ensuring that a serious accident doesn’t threaten your hard-earned assets.

FAQ Section

Why Should I Invest in UM/UIM If I Have Collision Coverage?

UM/UIM covers medical expenses and lost wages after an accident, which collision coverage does not. It’s important for your full financial protection.

What Happens In a Hit-And-Run Scenario – Does UM/UIM Cover Me?

In most cases, your UM policy can cover damages from a hit-and-run, as long as the accident is reported promptly to the police and your insurer.

Do All States Require Underinsured Motorist Coverage?

No, not all states require underinsured motorist coverage. It’s required in some states, optional in others. Check your state’s laws to be sure.

Is UM/UIM Worth It for Drivers With Comprehensive Health Insurance?

Yes, because UM/UIM can cover additional losses not covered by health insurance, such as lost wages and pain and suffering. It’s beneficial even with good health insurance.

Why Should I Invest in UM/UIM If I Have Collision Coverage?

Investing in UM/UIM even with collision coverage is a smart decision. Collision coverage repairs or replaces your car after an accident, regardless of who is at fault. However, it doesn’t cover medical bills or lost wages—that’s where UM/UIM shines. With UM/UIM, you ensure that you’re covered for the full range of expenses you could incur from an accident involving an uninsured or underinsured driver, not just vehicle damage. It’s a comprehensive strategy that safeguards both your health and your financial wellbeing.

What Happens In a Hit-And-Run Scenario – Does UM/UIM Cover Me?

In a hit-and-run scenario, UM/UIM coverage often becomes your financial lifeline. H3: What Happens In a Hit-And-Run Scenario – Does UM/UIM Cover Me?

In a hit-and-run scenario, UM/UIM coverage often becomes your financial lifeline. If the fleeing driver is nowhere to be found, it’s treated like an uninsured motorist situation, and your UM coverage typically steps in. It can cover car repairs, medical expenses, and even lost wages if you’re injured. Filing an uninsured motorist claim with your auto insurance can help you recover costs from damages and injuries up to your policy’s limit. However, it’s crucial that you report the incident to the police right away and file the claim with your insurer as per their guidelines to qualify for coverage. Different states and policies may have specific conditions, so it’s important to read the fine print of your insurance contract.

Do All States Require Underinsured Motorist Coverage?

Not all states have mandatory underinsured motorist coverage laws. Each state sets its own requirements, and while some do demand it, others offer it as a choice you can either add on or opt out of with your policy. It’s a patchwork of regulations, so you should definitely check the specific requirements for your state. Even if it’s not required where you live, it’s worth considering for the extra layer of protection it offers.

Is UM/UIM Worth It for Drivers With Comprehensive Health Insurance?

Yes, UM/UIM is undoubtedly worth it, even for drivers with comprehensive health insurance. While your health insurance may cover medical costs, UM/UIM coverage extends to areas it doesn’t reach. Think about lost wages if you can’t work after an accident, or the possible need for long-term care that might exceed your health plan’s limits. In some states, Uninsured Motorist Property Damage coverage can be pivotal if a hit-and-run driver damages your vehicle. Plus, UM/UIM can offer compensation for pain and suffering, which isn’t typically covered by health insurance. Underinsured coverage becomes crucial when the at-fault driver’s liability coverage isn’t adequate to cover your medical expenses. Bottom line: UM/UIM complements your health insurance, ensuring you’re covered from all angles, including liability coverage for peace of mind.

Header Image by Netto Figueiredo from Pixabay

All we do is fight for injured victims. And we do not accept defeat.

(512) 996-6369

help@dfoxlaw.com

Address

206 W. Main Street #108, Ste B, Round Rock

TX 78664